Top 4 Biggest Myths about Selling a Restaurant

Many restaurant owners share the Top 4 Biggest Myths about selling a restaurant. Selling a restaurant is much different from selling other businesses, and many

Many restaurant owners share the Top 4 Biggest Myths about selling a restaurant. Selling a restaurant is much different from selling other businesses, and many

The Challenges to Selling a non-franchised restaurant differ from those selling a franchise brand. Restaurants that are Franchises are out selling independently owned restaurants for

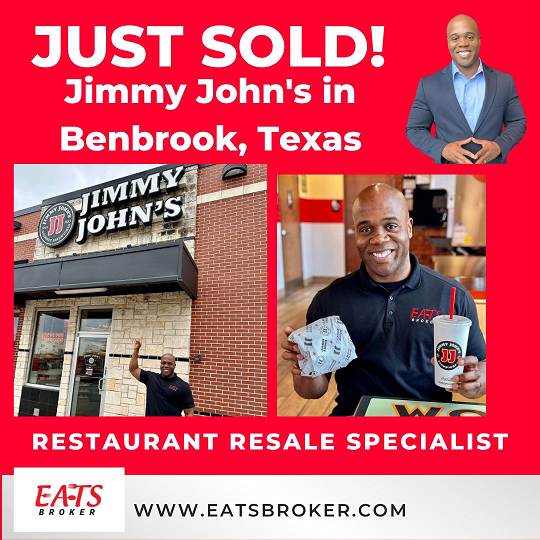

Restaurant Broker Dominique Maddox of EATS Broker sells Jimmy John’s in Benbrook, Texas. EATS Broker represented the seller and buyer for this transaction. The buyer

Want to sell your restaurant, and it’s time to create an equipment list? What Restaurant equipment do you own as a restaurant owner? This seems

The most demanding restaurants to sell fall into three categories. Chef-driven restaurants, BBQ restaurants, and unprofitable restaurants or new openings. All three types of restaurants

Asset Sale Restaurants are HOT right now because several restaurant owners that need to sell were not profitable in 2022. What is an Asset Sale

Are you thinking about selling your franchise restaurant in 2023? We have finished the Holiday season, and now it’s time to get ready to start

A Restaurant Owner should start planning an exit strategy before signing the lease. Thinking about the exit strategy should be as important as planning for

The start of a new year brings an increase in the inventory of listed restaurants for sale. There are three types of Restaurants for Sale

© Copyright 2025 EATS Broker | Consumer Protection Notice | Information About Brokerage Services