Marquis Who’s Who Honors Dominique Maddox

Marquis Who’s Who Honors Dominique Maddox for Expertise in Restaurant Franchise Resales. Established in 1898, Marquis Who’s Who began publishing biographical data in 1899. The publication chronicles the lives of the most accomplished individuals from every professional field, including business, entertainment, politics, medicine, law, education, art, and religion—Marquis Who’s Who has been a valuable resource […]

Checklist for Selling a Restaurant

Restaurant Broker provides a Checklist to Sell a Restaurant

What is EATS Broker

When it comes to the question, ‘What is EATS Broker? ‘, the founder and President, Dominique Maddox, is best positioned to answer. With his extensive experience selling restaurants, including seven years with one of the nation’s largest restaurant brokerage firms, he is uniquely positioned to lead the Restaurant Brokerage. EATS Broker stands out as a […]

Why Restaurant Resales Fail-Restaurant Broker Thoughts

This blog is the first time EATS Broker shares its thoughts about why Restaurant Resales fail in today’s market. Before restaurant owners open the doors and go through the excitement of opening a new restaurant, they should have an exit strategy. H.G. Parsa, an Associate professor of hospitality management at Ohio State University, conducted a […]

EATS Broker sells Smoothie King in Savannah, Georgia

Dominique Maddox of EATS Broker sells Smoothie King, located at 4317 Ogeechee Rd, Suite 104, Savannah, GA 31405. EATS Broker represented the Seller and buyer during the transaction. The Seller was referred to EATS Broker by another Business Broker who didn’t like selling restaurants. EATS Broker received a 5-star Google review from the Seller: “Dominique is […]

EATS Broker joins the Expert Panel Discussion

EATS Broker participated in the highly informative Expert Panel Discussion at the Georgia Association of Business Brokers (GABB) May General Meeting. The panel, consisting of seasoned Business Brokers, shared best practices and answered commonly asked questions about business brokerage. The event was designed to allow new and experienced business brokers to ask seasoned brokers questions […]

EATS Broker attends International Business Brokers Association Conference

Dominique Maddox of EATS Broker attends the International Business Brokers Association conference at the Galt House in Louisville, Kentucky. The IBBA conference brings the top business brokers from around the nation together to foster professional growth, knowledge sharing, and the promotion of ethical practices worldwide. It is known as the Business Broker Event of the Year. This […]

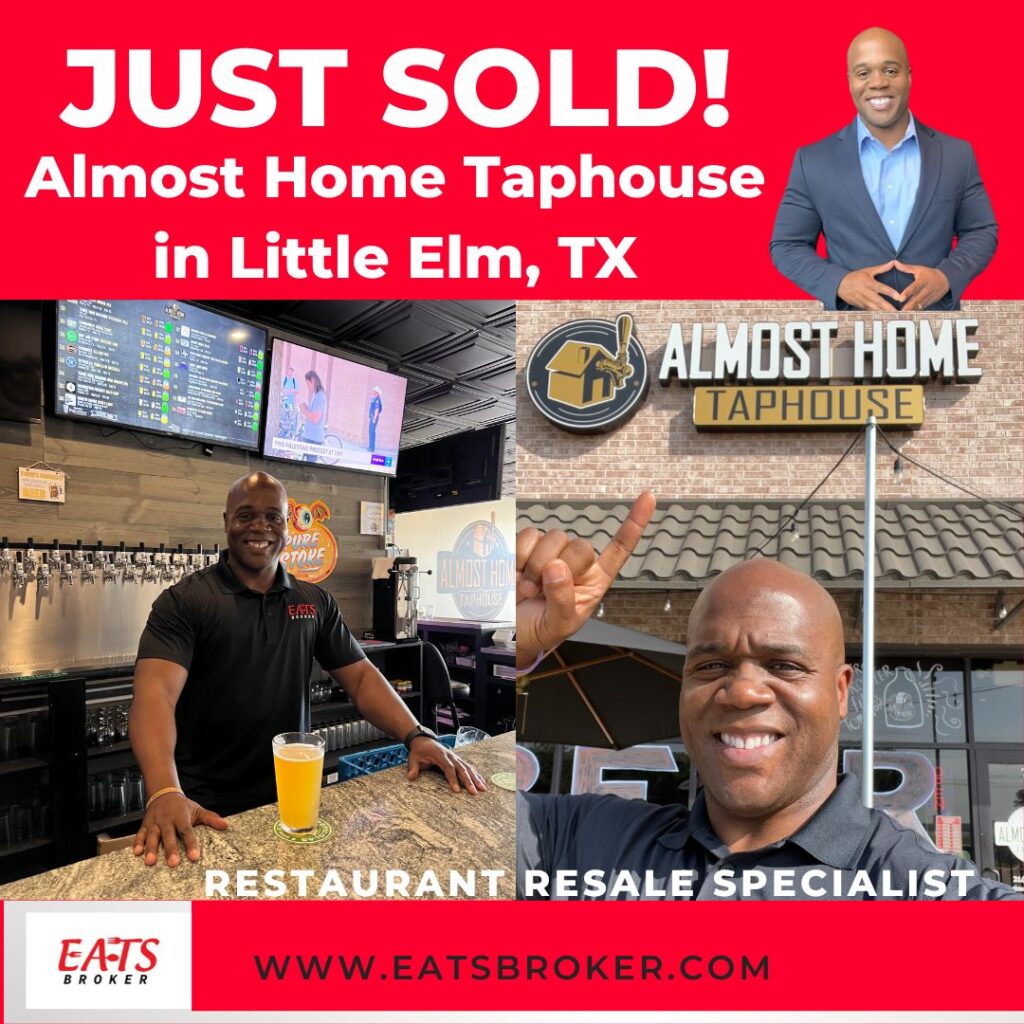

EATS Broker sells Almost Home Taphouse in Little Elm, Texas

Dominique Maddox of EATS Broker sells Almost Home Taphouse in Little Elm, Texas. EATS Broker was the Business Intermediary for the seller and buyer during the transaction. EATS Broker received a 5-star Google review from the sellers: Dominique was easy to work with during the process. He always responded quickly to any questions and helped […]

Selling a restaurant business

What are the steps to the closing table when selling a restaurant business? Each restaurant resale transaction is different because the terms and participating professionals change. Selling a non-franchise restaurant is a different sales process than selling a franchise restaurant. Selling a restaurant with SBA lending involves many more steps than closing a cash deal […]