Time to sell your restaurant? How to defend your listing price

When it’s time to sell your Restaurant, how do you plan to defend your listing price? This question is excellent for anyone considering hiring a Restaurant Broker or For Sale by Owner. It’s easy to think of a random number, list a restaurant for sale, and answer buyer inquiries. Selling a restaurant is like fishing; […]

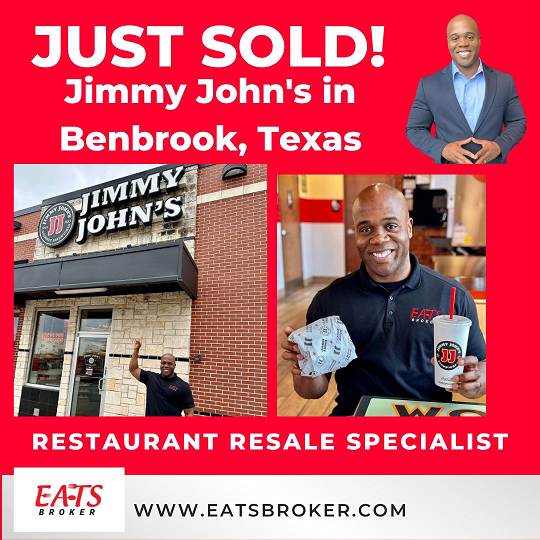

Restaurant Broker Dominique Maddox of EATS Broker sells Jimmy John’s franchise

Restaurant Broker Dominique Maddox of EATS Broker sells Jimmy John’s in Benbrook, Texas. EATS Broker represented the seller and buyer for this transaction. The buyer is a multi-unit owner expanding his territory and ownership in Jimmy John’s. The new ownership group takes over a successful location with sales of over $840,000 in 2022. The seller […]

Thinking about selling a restaurant in 2023

It’s the time of the year when restaurant owners are thinking about selling a restaurant in 2023. It’s been a challenging year with increased labor costs, supply chain issues, food price inflation, and a lack of government financial assistance. At the end of the year, some Restaurant owners must sacrifice time spent with their loved […]

4 Tips – How to Sell a Restaurant

How to Sell a Restaurant and get the highest and best offer can be challenging. Restaurant owners can help themselves sell a restaurant by checking their “restaurant paperwork” details before listing it for sale! When selling a restaurant, the real work starts before the restaurant has been listed for sale. An experienced restaurant owner should […]

Step by Step Process to Buy a Restaurant Franchise

The Step by Step process to buy a restaurant franchise for sale can be a complex process with multiple guidelines, requirements, and documentation to read. Did you know the top restaurant brands have a Checklist that potential franchisees have to complete before they can purchase a Franchise Restaurant Resale? The Restaurant Resale Specialist at EATS […]

Pros and Cons for a Restaurant Asset Sale

The Pros and Cons of buying or selling a restaurant as an Asset Sale can be a Win-Win situation for both parties. In an asset sale, the seller retains possession of the legal business entity name and stocks, and the buyer only purchases the company’s assets. The assets include equipment, leasehold improvements, Goodwill, trade secrets, […]

Commercial Lease Assignment: What should you know?

What should you know about a Commercial Lease Assignment before signing the lease? The lease assignment can be short and brief, but it has a tremendous impact on the capability of a restaurant owner selling a restaurant in the future. When buying or selling a restaurant, it is essential to evaluate the strength or weakness […]

Independent Owned Restaurants-How to Build Value?

As an Independent Owned Restaurant, how do you increase restaurant value for resale besides good food and environment? Independent Owned Restaurants for sale usually sell for less than Franchise Owned Restaurants. Franchise Restaurants for sale provide a potential buyer with systems, training, and brand awareness to customers; these are non-tangible items that improve resale value. […]

Restaurant Resales are HOT right now

Restaurant Resales are HOT regarding buyer’s demand as restaurant sale prices jump 34% in 2021 compared to 2020. BizBuySell’s Insight Report just released its report for Quarter 2 of 2021. Restaurant resale numbers are showing very promising growth and buyer interest. Restaurant resales headline growth as the buyer market seeks reopening opportunities. Now with restrictions […]