Documentation required when Selling a Restaurant

The Documentation required when selling a restaurant can depend on several factors. Once the buyer’s offer is accepted, the restaurant owner starts to think about how to complete due diligence. This essential step involves the buyer examining the restaurant documentation to determine the value, goodwill, intellectual property, and condition of furniture fixtures and equipment. Every […]

3 Common Mistakes Restaurant Buyers Make

What are the Common mistakes restaurant buyers make when buying a restaurant? The answer is complicated but simple at the same time. There are several common mistakes that potential restaurant buyers should be aware of when deciding to buy a restaurant. The Restaurant Broker at EATS Broker provides some of the most common mistakes restaurant […]

EATS Broker attends Black Franchise Symposium and Trade Show in Dallas, Texas

The President and Founder of EATS Broker Dominique Maddox attended the September African American Franchise Symposium and Trade show in Dallas, Texas. The event made history as the FIRST-EVER Black Franchise Symposium and Trade Show in the United States! The event was held at Yum! Corporate Campus located in Plano, Texas. The Symposium was filled […]

How to Grade a Restaurant for Sale

How to grade a restaurant for sale is a good question for a restaurant owner. Since Pre-K, most have been taught to judge performance by our grades. Office Buildings in Commercial Real Estate are placed in one of three categories: class A, class B, or Class C. A building rating is a national benchmark. Each […]

Buying a Restaurant with SBA Lending. Things to Know

Buying a Restaurant with SBA lending is a great opportunity for buyers to finance up to 90% of the total acquisition cost. Restaurant Acquisitions are eligible for Small Business Administration (SBA) 7(a) loans, but the process can be time-consuming and requires many supporting documents. The restaurant buyer’s and the restaurant seller’s financial documents must be […]

10 Ten Interesting Facts about the Restaurant Industry

It’s easy to find interesting facts about the Restaurant Industry. The National Restaurant Association publishes a Restaurant Owner Demographics Data Brief every year. After reading the March 2022 Data Brief, the Restaurant Broker at EATS Broker picked ten interesting facts. Hawaii (64%), Texas (59%), California (58%), Georgia (55%), Maryland (54%), and the District of Columbia […]

4 Worst Decisions when selling a Restaurant

Do you plan to sell a restaurant? What are the worst decisions when selling a restaurant? EATS Broker will provide an inside look at why some restaurant sellers can be disappointed when it’s time to sell a restaurant. Did you know only 20%-30% of the restaurants listed on the market will sell to a new […]

EATS Broker sells a downtown Dallas, Texas Restaurant

EATS Broker sells a downtown Dallas, Texas Restaurant in the Mosaic Dallas building at 300 N Akard St, Dallas, TX 75201. EATS Broker was the Intermediary for the seller and buyer for this transaction. The restaurant is in a luxury, high-rise living community in downtown Dallas, Texas. Near the Arts District, Klyde Warren Park, and […]

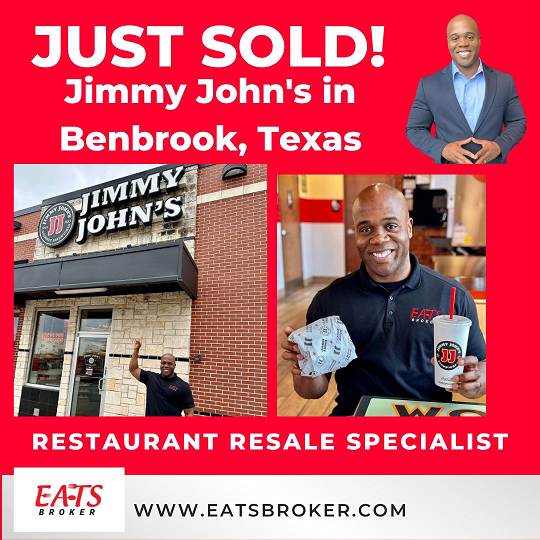

Restaurant Broker Dominique Maddox of EATS Broker sells Jimmy John’s franchise

Restaurant Broker Dominique Maddox of EATS Broker sells Jimmy John’s in Benbrook, Texas. EATS Broker represented the seller and buyer for this transaction. The buyer is a multi-unit owner expanding his territory and ownership in Jimmy John’s. The new ownership group takes over a successful location with sales of over $840,000 in 2022. The seller […]