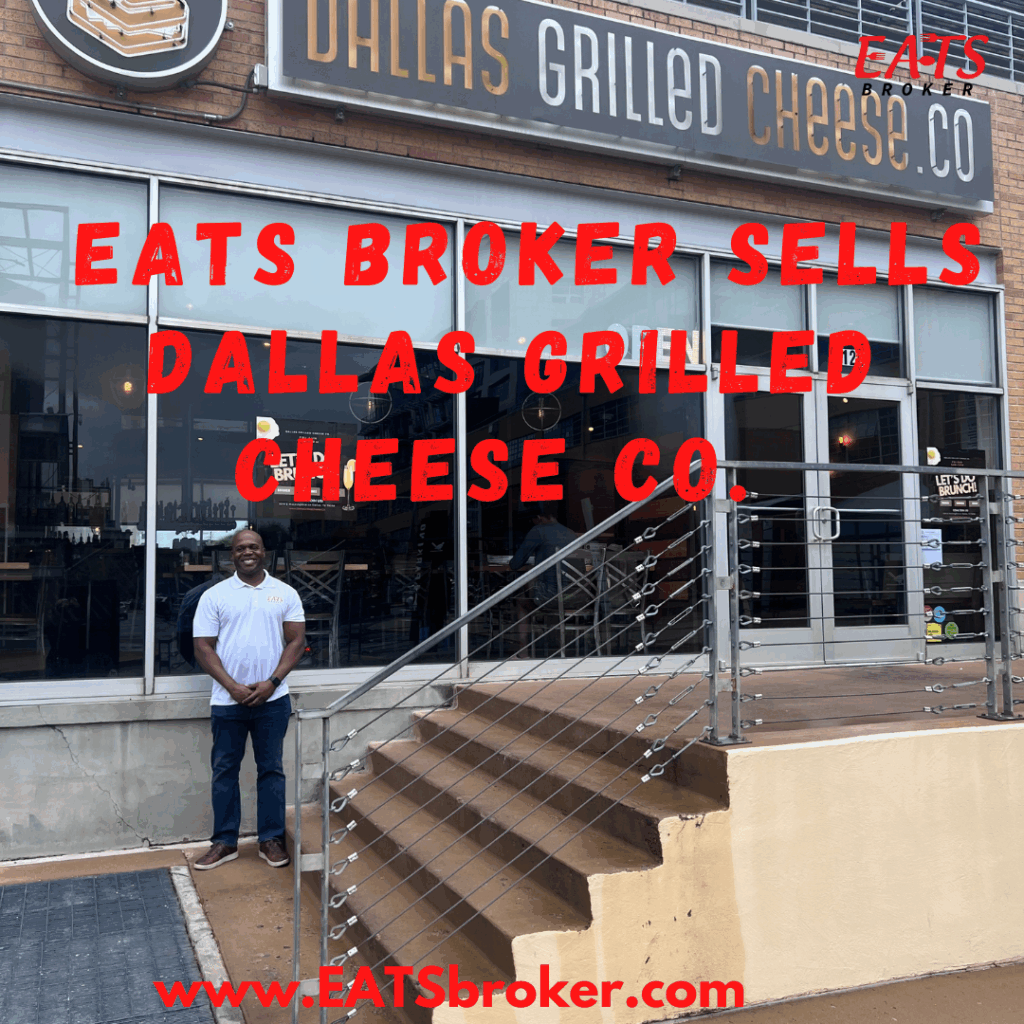

EATS Broker sells Dallas Grilled Cheese Co in Dallas, Texas

Dallas, Texas-EATS Broker, a leading restaurant brokerage firm located in Dallas, Texas, is pleased to announce the successful sale of Dallas Grilled Cheese Co located at 5319 E Mockingbird Ln, Dallas, TX 75206 in the Mockingbird Station Shopping Center. EATS Broker represented the Seller and the Buyer through a complex transaction, ensuring a smooth a successful closing. Dallas […]

How to Grow a Restaurant Franchise Brand

Franchisors are always looking for ways to Grow a Restaurant Franchise Brand, and growth strategies can fluctuate. The strategy can depend on whether the Restaurant Franchise Brand is Emerging or established. EATS Broker attended the webinar for the Franchise Times Outlook 2025. The webinar was filled with information, but as Restaurant Brokers, our attention was […]

How to Value a Restaurant: Four factors that matter

When the time comes to sell a restaurant business, most restaurant owners are often unsure about how to value their Establishment or the factors that make a difference. This uncertainty can make the selling process seem daunting. However, understanding the restaurant valuation process can provide a sense of relief, serving as the starting point for […]

What is EATS Broker

When it comes to the question, ‘What is EATS Broker? ‘, the founder and President, Dominique Maddox, is best positioned to answer. With his extensive experience selling restaurants, including seven years with one of the nation’s largest restaurant brokerage firms, he is uniquely positioned to lead the Restaurant Brokerage. EATS Broker stands out as a […]

Why Restaurant Resales Fail-Restaurant Broker Thoughts

This blog is the first time EATS Broker shares its thoughts about why Restaurant Resales fail in today’s market. Before restaurant owners open the doors and go through the excitement of opening a new restaurant, they should have an exit strategy. H.G. Parsa, an Associate professor of hospitality management at Ohio State University, conducted a […]

EATS Broker sells Smoothie King in Savannah, Georgia

Dominique Maddox of EATS Broker sells Smoothie King, located at 4317 Ogeechee Rd, Suite 104, Savannah, GA 31405. EATS Broker represented the Seller and buyer during the transaction. The Seller was referred to EATS Broker by another Business Broker who didn’t like selling restaurants. EATS Broker received a 5-star Google review from the Seller: “Dominique is […]

EATS Broker joins the Expert Panel Discussion

EATS Broker participated in the highly informative Expert Panel Discussion at the Georgia Association of Business Brokers (GABB) May General Meeting. The panel, consisting of seasoned Business Brokers, shared best practices and answered commonly asked questions about business brokerage. The event was designed to allow new and experienced business brokers to ask seasoned brokers questions […]

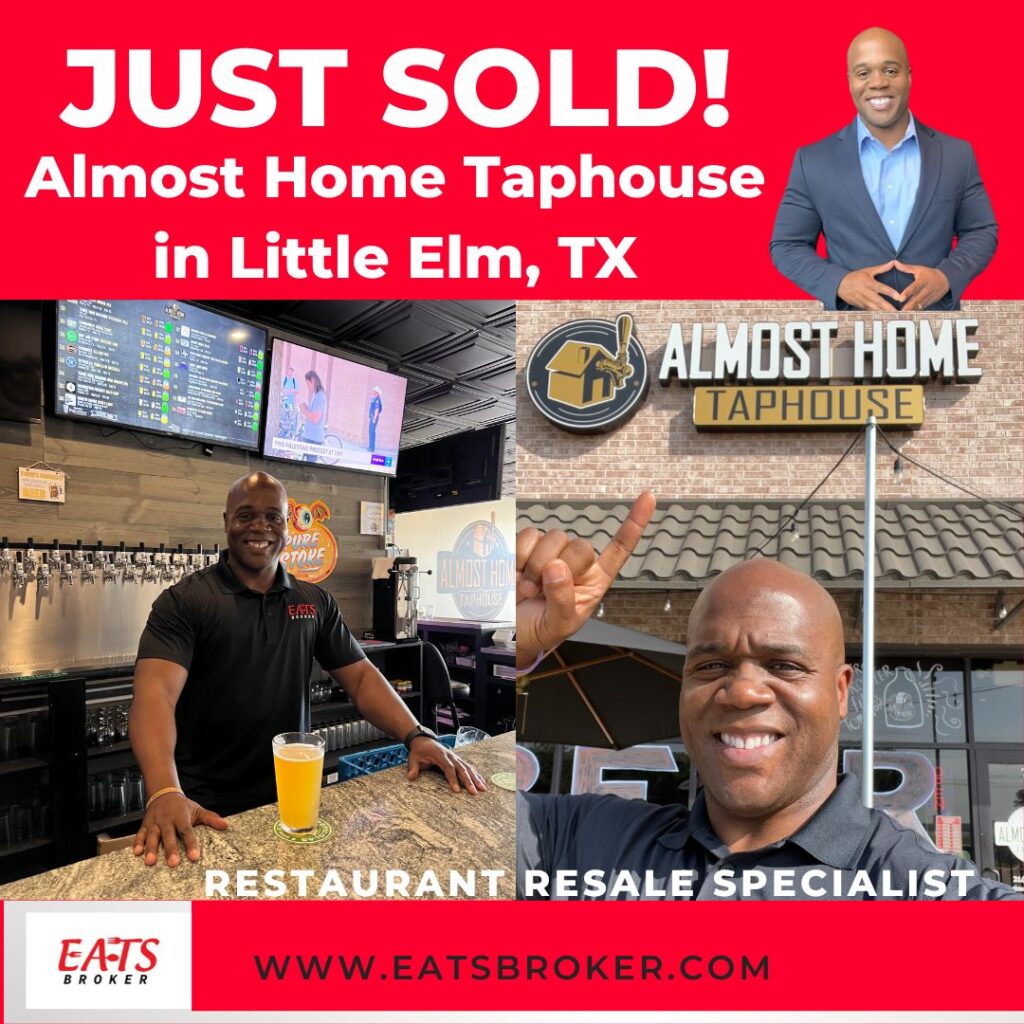

EATS Broker sells Almost Home Taphouse in Little Elm, Texas

Dominique Maddox of EATS Broker sells Almost Home Taphouse in Little Elm, Texas. EATS Broker was the Business Intermediary for the seller and buyer during the transaction. EATS Broker received a 5-star Google review from the sellers: Dominique was easy to work with during the process. He always responded quickly to any questions and helped […]

4 Tips for a Successful Restaurant Sale

EATS Broker provides 4 Tips for a Successful Restaurant Sale in 2024 to any restaurant owner considering selling a restaurant. Selling a restaurant can be challenging, with only 30%-40% of restaurants listed for sale selling. Selling a restaurant in 2024 comes down to careful planning and execution. The Restaurant Business Broker provides tips to ensure […]