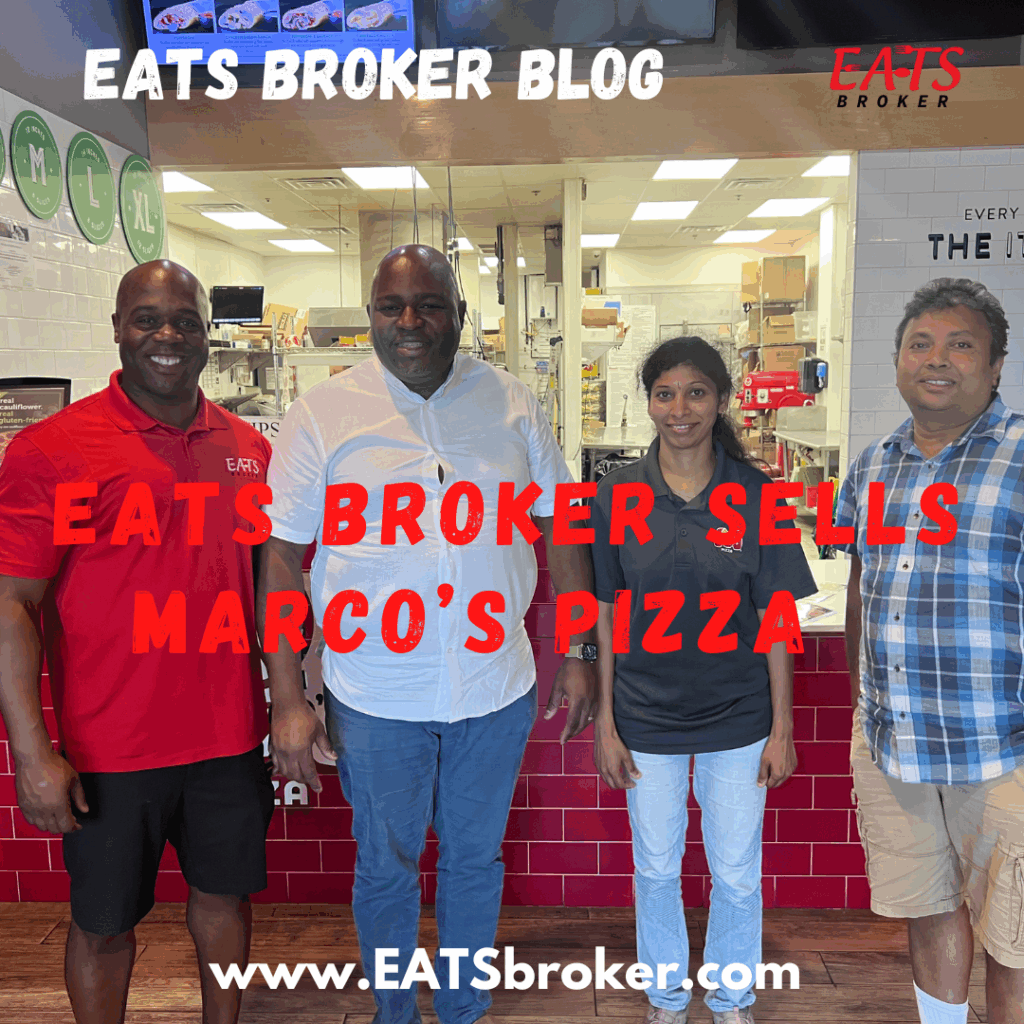

EATS Broker sells Marco’s Pizza in McKinney, Texas

Dallas, Texas-EATS Broker, a leading restaurant brokerage firm located in Dallas, Texas, is pleased to announce the successful sale of Marco’s Pizza located at 4100 Ridge Rd STE 102, McKinney, TX 75070 EATS Broker represented the Seller and the Buyer through a complex franchise resale transaction, ensuring a smooth a successful closing. Marco’s Pizza is one of the […]

Dominique Maddox of EATS Broker attends the International Business Brokers Association (IBBA) Conference

Dominique Maddox of EATS Broker attended the International Business Brokers Association (IBBA) Conference in Orlando, Florida. The IBBA has over 3,000 members from various countries. The annual conference is known as the Business Broker event of the year. The Restaurant Broker qualified for the Top Producers award and walked away from the event with his […]

How to Sell a Non-Profitable Restaurant: A Step-by-Step Guide

A common problem for restaurant owners is selling a non-profitable restaurant. Did you know that owning a restaurant is one of the most demanding jobs in the world? The average restaurant will close within five years. If you’re overwhelmed by financial liabilities, health insurance, divorce, partnership issues, legal issues, or simply ready to retire, you’re […]

Dominique Maddox Achieves Certified Business Intermediary (CBI) Designation, Strengthening Expertise in Restaurant Brokerage

Dallas, TX – March 27, 2025 – EATS Broker proudly announces that its Founder and President, Restaurant Broker Dominique Maddox, has earned the prestigious Certified Business Intermediary (CBI) designation from the International Business Brokers Association (IBBA). This esteemed certification further solidifies Maddox’s position as a leading expert in restaurant brokerage, making him one of the […]

When selling a restaurant, do you need a Restaurant Broker

When selling a restaurant, owners must decide whether to use a Restaurant Broker or try to sell themselves. Finding the right Restaurant Brokerage to help sell a restaurant can be challenging. All Restaurant Brokerage firms are different. A Restaurant Business Broker is often a powerful asset in restaurant sales transactions. When selling a restaurant, do […]

Best way to market your restaurant for sale

The best way to market your restaurant for sale is to hire a Restaurant Business Broker, but if you decide to do a for-sale-by-owner, keep reading this blog. The most important part of marketing your restaurant for sale is getting it ready to be sold. The prep work includes creating a marketing plan, deciding on […]

Selling a Restaurant. What do buyers want to see?

It’s a busy time of year for buyers looking to buy a restaurant. What do buyers want to see when they inquire about a restaurant? The answer depends on the type of restaurant. Was the restaurant profitable in 2025? The answer will determine the documents and financials a buyer will request. The average buyer, when […]

Documentation required when Selling a Restaurant

The Documentation required when selling a restaurant can depend on several factors. Once the buyer’s offer is accepted, the restaurant owner starts to think about how to complete due diligence. This essential step involves the buyer examining the restaurant documentation to determine the value, goodwill, intellectual property, and condition of furniture fixtures and equipment. Every […]

Checklist for Selling a Restaurant

EATS Broker provides a checklist for selling a restaurant