What is a Restaurant Broker

A Restaurant Broker is a trained Business Broker who specializes in selling restaurants, bars, and nightclubs. Daily, a Restaurant Broker talks with restaurant owners, reviews restaurant tax returns and profit and loss statements, and answers buyer inquiries. Restaurant Brokers work in a niche industry of Business Brokerage solely focused on helping restaurant owners. A restaurant […]

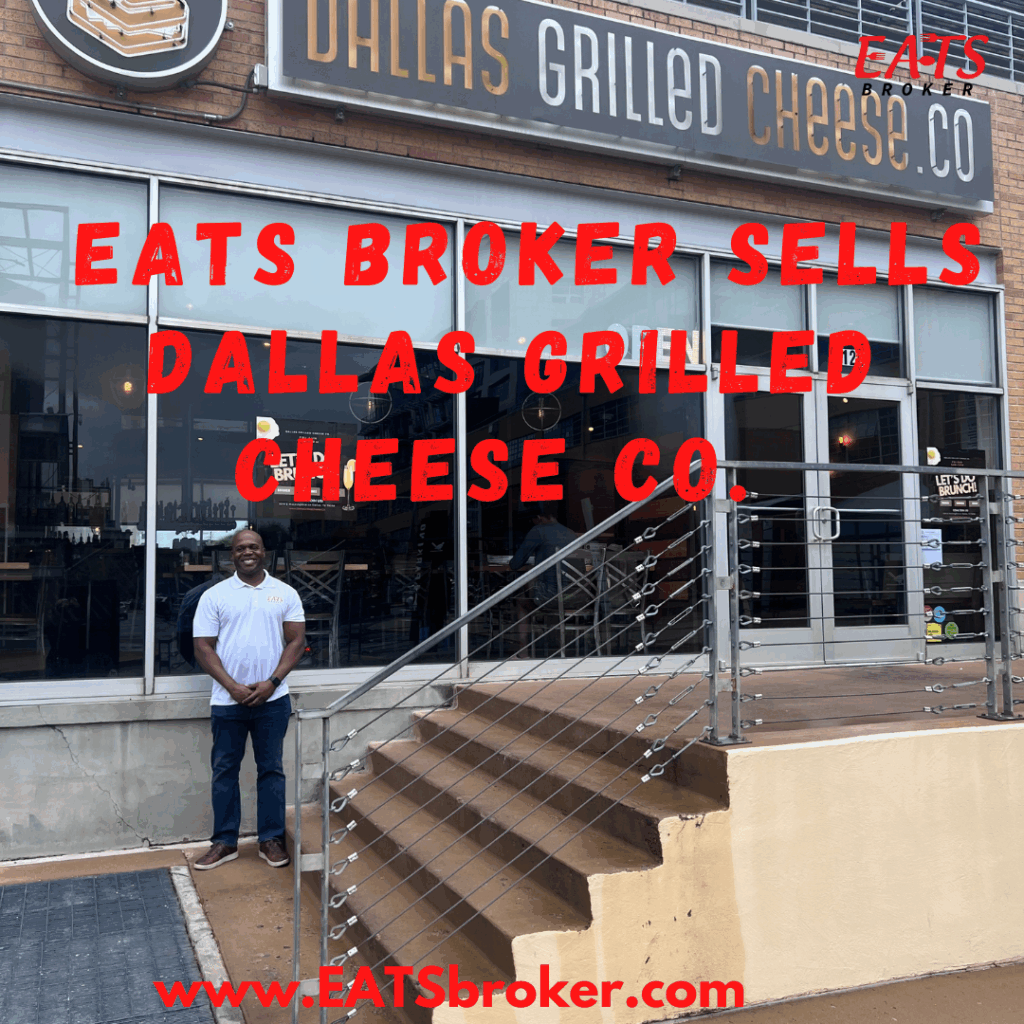

EATS Broker sells Dallas Grilled Cheese Co in Dallas, Texas

Dallas, Texas-EATS Broker, a leading restaurant brokerage firm located in Dallas, Texas, is pleased to announce the successful sale of Dallas Grilled Cheese Co located at 5319 E Mockingbird Ln, Dallas, TX 75206 in the Mockingbird Station Shopping Center. EATS Broker represented the Seller and the Buyer through a complex transaction, ensuring a smooth a successful closing. Dallas […]

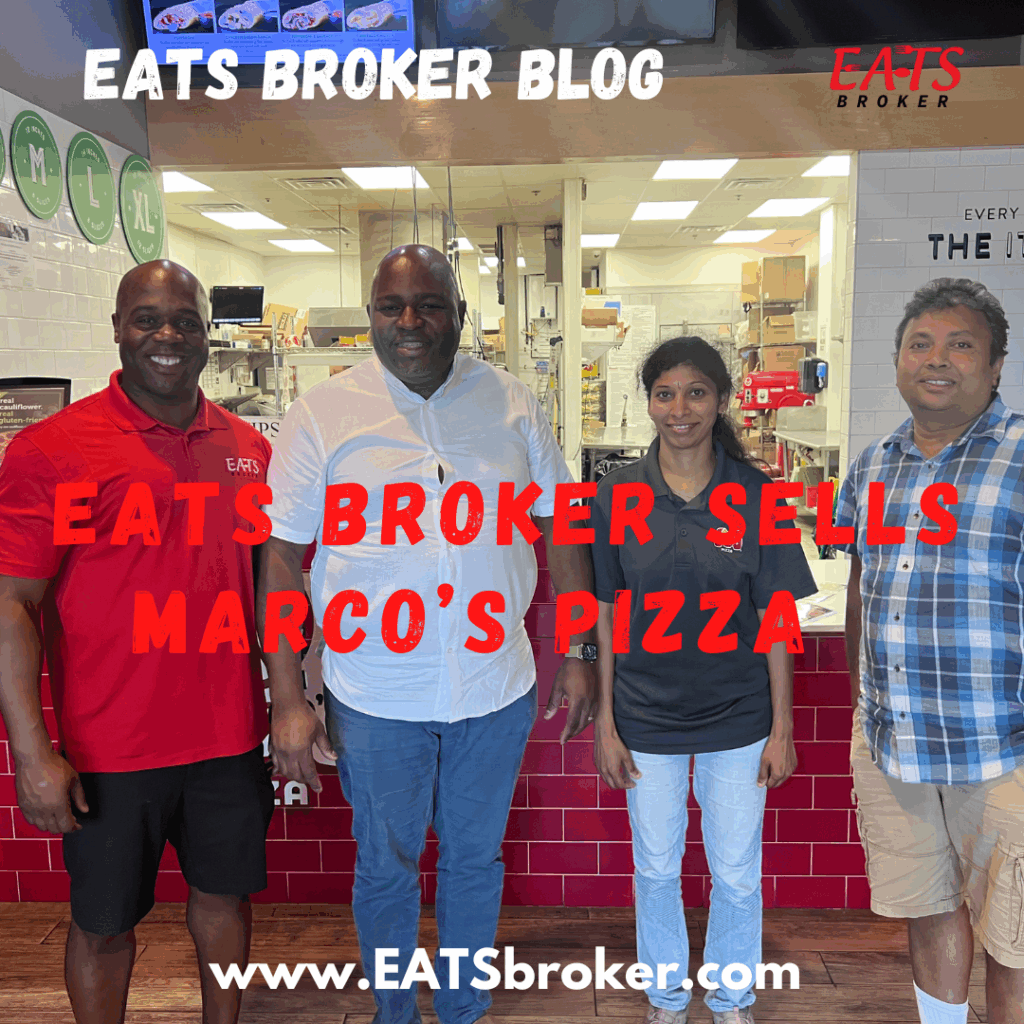

EATS Broker sells Marco’s Pizza in McKinney, Texas

Dallas, Texas-EATS Broker, a leading restaurant brokerage firm located in Dallas, Texas, is pleased to announce the successful sale of Marco’s Pizza located at 4100 Ridge Rd STE 102, McKinney, TX 75070 EATS Broker represented the Seller and the Buyer through a complex franchise resale transaction, ensuring a smooth a successful closing. Marco’s Pizza is one of the […]

What is a Restaurant Brokerage

What is a restaurant brokerage? This is a question that is frequently asked by restaurant owners looking to sell their businesses. A Restaurant Brokerage is created by a business broker who specializes in helping restaurant owners with the transaction of selling a restaurant or acquiring restaurants through acquisitions. Restaurant Brokerage firms provide restaurant valuations to […]

Dominique Maddox of EATS Broker attends the International Business Brokers Association (IBBA) Conference

Dominique Maddox of EATS Broker attended the International Business Brokers Association (IBBA) Conference in Orlando, Florida. The IBBA has over 3,000 members from various countries. The annual conference is known as the Business Broker event of the year. The Restaurant Broker qualified for the Top Producers award and walked away from the event with his […]

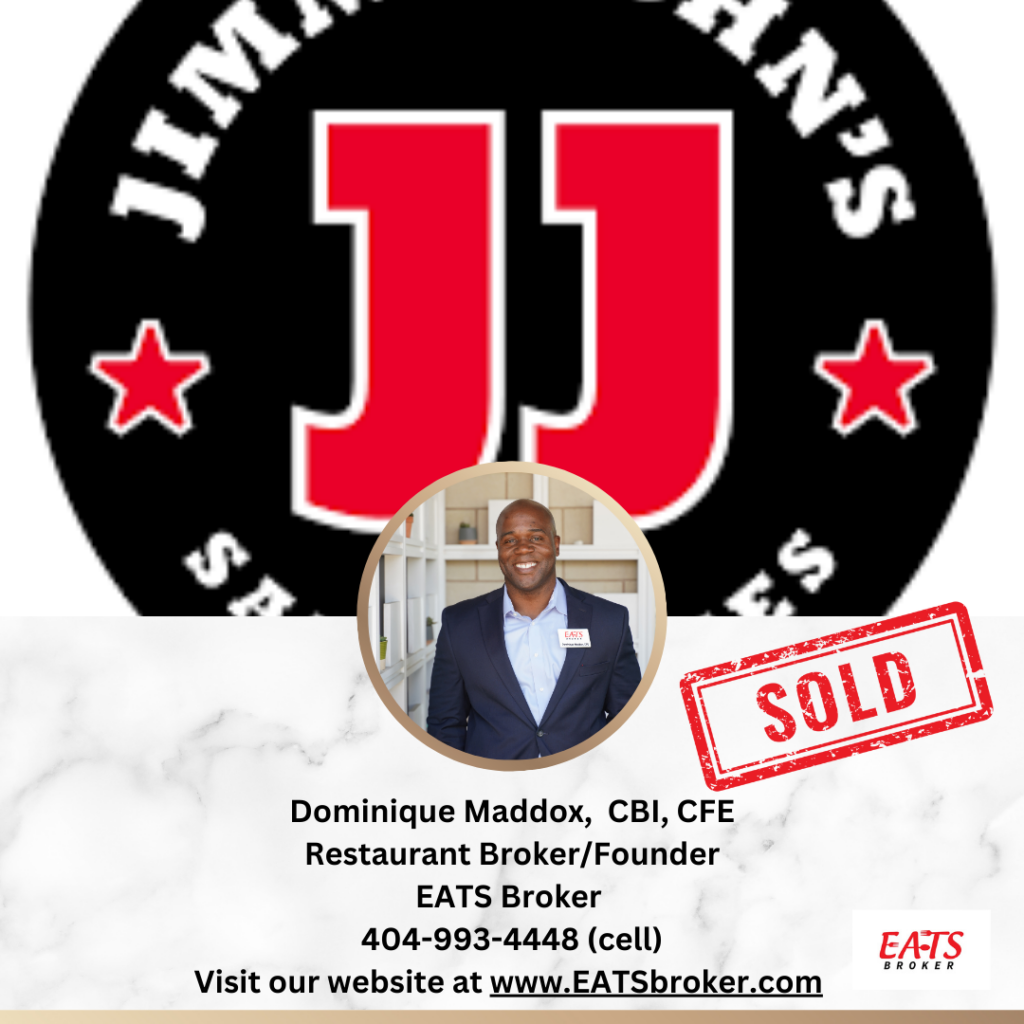

Dominique Maddox of EATS Broker sells Jimmy John’s in New York

Dominique Maddox of EATS Broker sells Jimmy John’s in Ithaca, New York located at 122 N Aurora St, Ithaca, NY 14850. EATS Broker was the Business Intermediary for the seller and buyer during the transaction. EATS Broker received a 5-star Google review from the seller: I can’t say enough great things about Dominique. It’s hard […]

Selling a Restaurant- A Guide to Working with buyers

When selling a restaurant, most restaurant owners don’t have a guide to work with buyers, so they are clueless about the restaurant resale process. Today’s buyers are more educated than ever, and many will Google the process of buying a restaurant and have a checklist of items to request. Selling a restaurant is more than […]

How to Sell a Non-Profitable Restaurant: A Step-by-Step Guide

A common problem for restaurant owners is selling a non-profitable restaurant. Did you know that owning a restaurant is one of the most demanding jobs in the world? The average restaurant will close within five years. If you’re overwhelmed by financial liabilities, health insurance, divorce, partnership issues, legal issues, or simply ready to retire, you’re […]

Dominique Maddox Achieves Certified Business Intermediary (CBI) Designation, Strengthening Expertise in Restaurant Brokerage

Dallas, TX – March 27, 2025 – EATS Broker proudly announces that its Founder and President, Restaurant Broker Dominique Maddox, has earned the prestigious Certified Business Intermediary (CBI) designation from the International Business Brokers Association (IBBA). This esteemed certification further solidifies Maddox’s position as a leading expert in restaurant brokerage, making him one of the […]